Multi-generational living is here to stay in a low wage economy

Posted by mybudget360

22 November 2014

The Great Recession might be officially over on paper, but the social

impact continues to be felt today. The structural changes are deep and

profound and have caused a major rise in multi-generational households.

Many young Americans burdened by low wage jobs and college debt

may have no other option but to move back home with parents. The number

of people living in such households has doubled since 1980. More than

18 percent of the population now lives in this arrangement. A large push

has come from those 25 to 34 given that 1 in 4 now live in a household

with multiple generations. Money is tight and rising living expenses

including rents have kept many from venturing out on their own. The

economy has been adding jobs but many of these jobs are coming from the

low wage sector and are simply not providing a base for moving out. This

latest election was driven by people unhappy with the economy but also

wanting higher wages.

Living at home

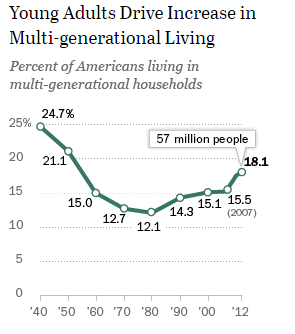

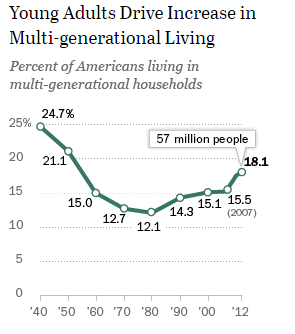

Multi-generational living used to be the common way of living in the 1940s and 1950s. The trend was unmistakably moving lower for an entire generation until it hit a bottom in the 1980s. Since that time, it has gradually shifted higher.

The recent Great Recession has accelerated this trend:

Source: Pew Research

57 million people now live in multi-generational households. Young adults have been the driving force of this trend. Two main factors are pushing this trend:

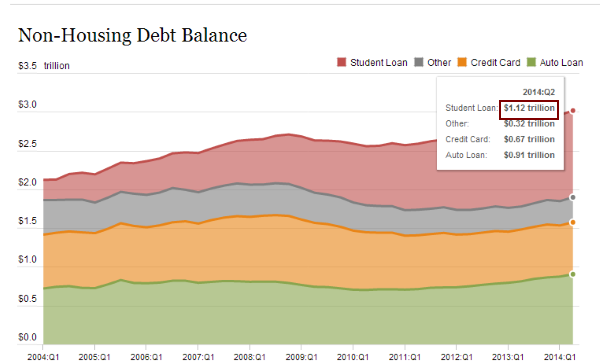

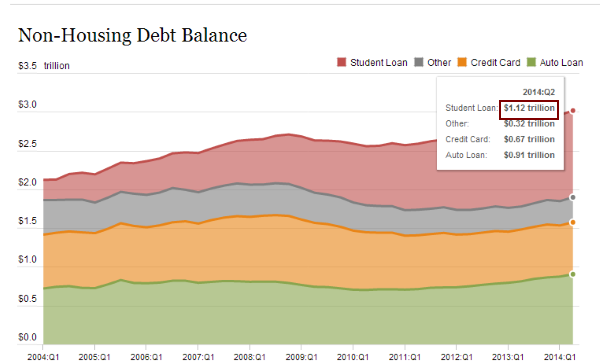

Student debt is now the largest non-housing debt in the economy. This hinders young adults from moving out on their own and forming new households. You also have low wage jobs dominating the employment sector so young adults simply do not have the income coming in to support a new household.

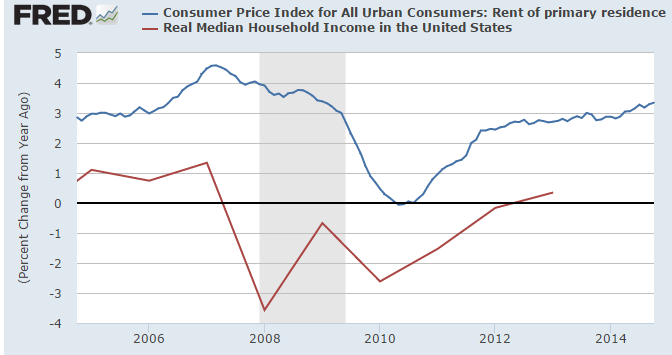

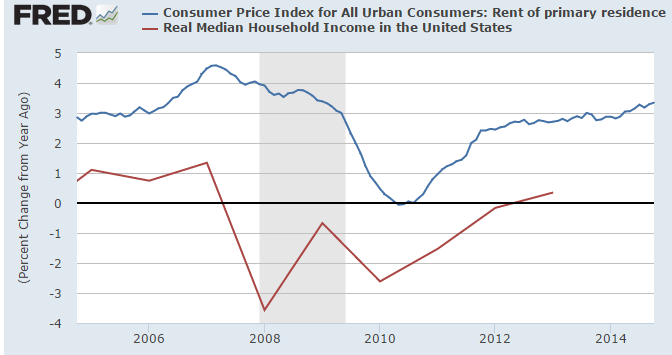

Ironically the big banking bailouts supported a feverish hunger for investment properties from large investors crowding out many future households. This made buying a single family home much more expensive but also drove the cost of rents higher:

Rents are going up much faster than actual household incomes.

This is another big reason why many young adults are unable to venture out on their own and start new households.

Household formation is a key driver in our economy. Many new households drive spending in large goods like refrigerators, furniture, and electronics. Instead one fridge, you now have two when a young adult ventures out to form their own household. The current trend is reversing this so we should see this seep into consumer spending.

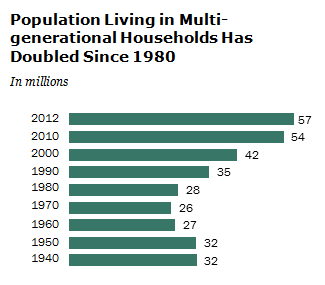

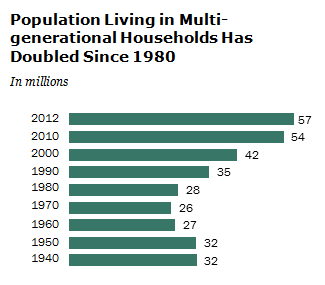

The raw numbers of multi-generational households are large:

The numbers have doubled since 1980 with the trend accelerating since the Great Recession hit. There doesn’t seem to be any reversing of this trend in the short-term but what this does highlight is an economy that is especially hard on young adults.

Source

Posted by mybudget360

22 November 2014

Living at home

Multi-generational living used to be the common way of living in the 1940s and 1950s. The trend was unmistakably moving lower for an entire generation until it hit a bottom in the 1980s. Since that time, it has gradually shifted higher.

The recent Great Recession has accelerated this trend:

Source: Pew Research

57 million people now live in multi-generational households. Young adults have been the driving force of this trend. Two main factors are pushing this trend:

-1. College debtThe student debt bubble seems to be in the news every day yet student debt continues to grow:

-2. Low wage employment

Student debt is now the largest non-housing debt in the economy. This hinders young adults from moving out on their own and forming new households. You also have low wage jobs dominating the employment sector so young adults simply do not have the income coming in to support a new household.

Ironically the big banking bailouts supported a feverish hunger for investment properties from large investors crowding out many future households. This made buying a single family home much more expensive but also drove the cost of rents higher:

Rents are going up much faster than actual household incomes.

This is another big reason why many young adults are unable to venture out on their own and start new households.

Household formation is a key driver in our economy. Many new households drive spending in large goods like refrigerators, furniture, and electronics. Instead one fridge, you now have two when a young adult ventures out to form their own household. The current trend is reversing this so we should see this seep into consumer spending.

The raw numbers of multi-generational households are large:

The numbers have doubled since 1980 with the trend accelerating since the Great Recession hit. There doesn’t seem to be any reversing of this trend in the short-term but what this does highlight is an economy that is especially hard on young adults.

Source